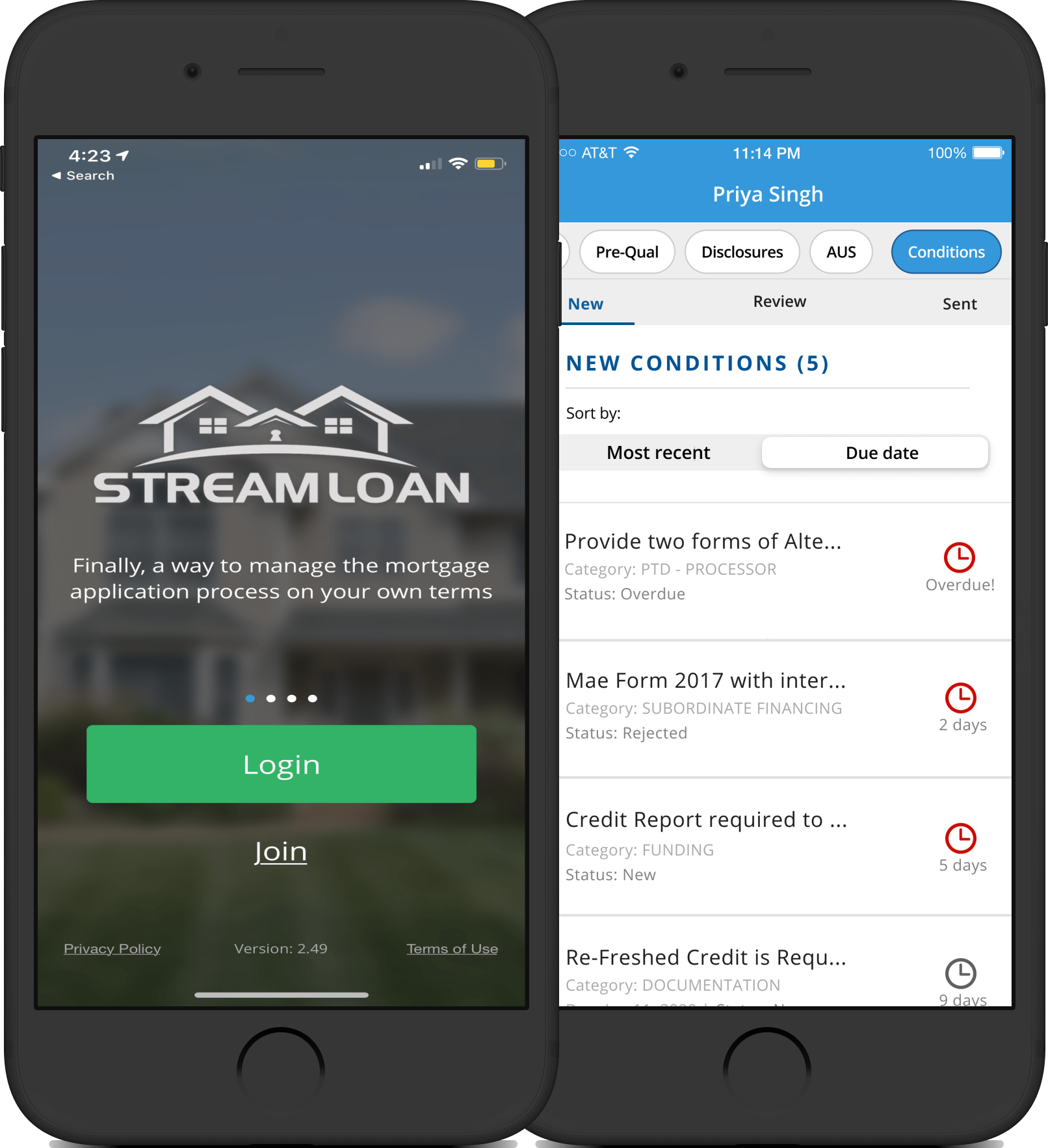

StreamLoan

Helping loan officers manage loan requirements

Role & Duration:

User Research, Product Strategy, UX/UI Design, Information Architecture, Prototyping, and Usability Testing 6 weeks

About StreamLoan:

StreamLoan is an early stage startup with the mission to make the “the journey to home ownership as rewarding as the destination” by reducing friction in the residential home buying and lending processes. The web and mobile platform offers an end-to-end digital mortgage solution taking the borrower from the point of intent, purchase, to closing.

Business Goals:

- Shorten mortgage closing cycle times

- Increase loan officer satisfaction by 30%

The Problem

Loan officers struggle to collect the right documents from borrowers before deals fall through

Once a loan requirement (loan condition) is sent to a borrower, the countdown begins. Loan officers have to race to get the right documents from the borrower while acting as a legalese translator and coordinator through a confusing and emotional process. If loan requirements aren't met in time, the borrower loses out on the loan and the loan officer loses the commision.

Design scope & strategy

Scoping around an outdated UI

Loan officers were unable to complete all of their required tasks within the StreamLoan app. The new loan requirements feature (Phase 1) was prioritized over the redesign of the outdated UI (Phase 2). I worked with the client to help improve loan officer satisfaction with the new loan requirements feature.

Design Phase 1

Design and build the new loan requirements feature

Design Phase 2

Update the outdated UI & design system

Design Phase 3

Add or improve StreamLoan features

The Solution

A centralized location to quickly track and manage loan requirements

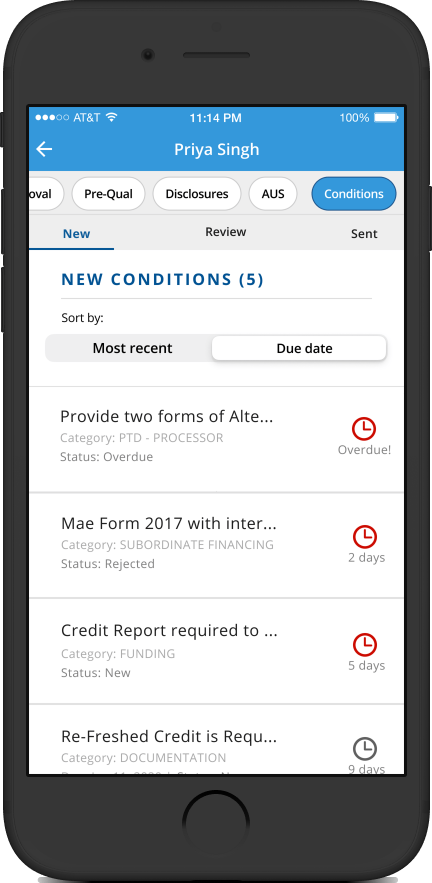

Unbelievably easy loan progress management

Quickly assign loan requirements, review uploaded documents, and send messages so you can spend more time building your business.

Never miss a deadline

Upcoming deadline? See requirement due dates and progress at a glance.

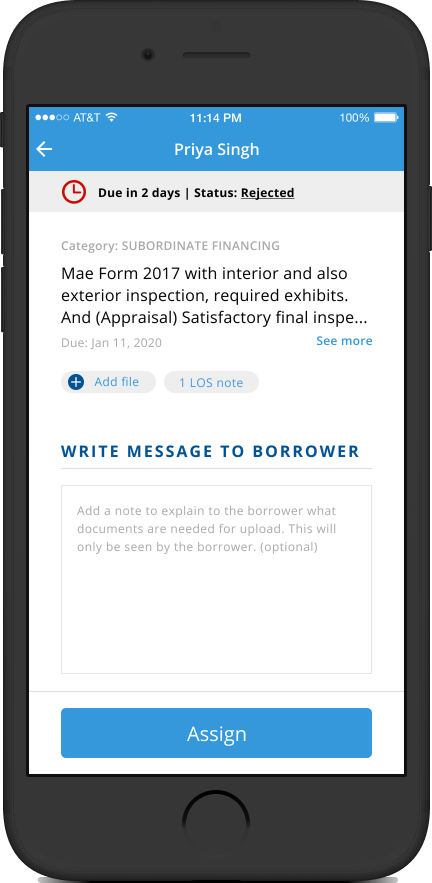

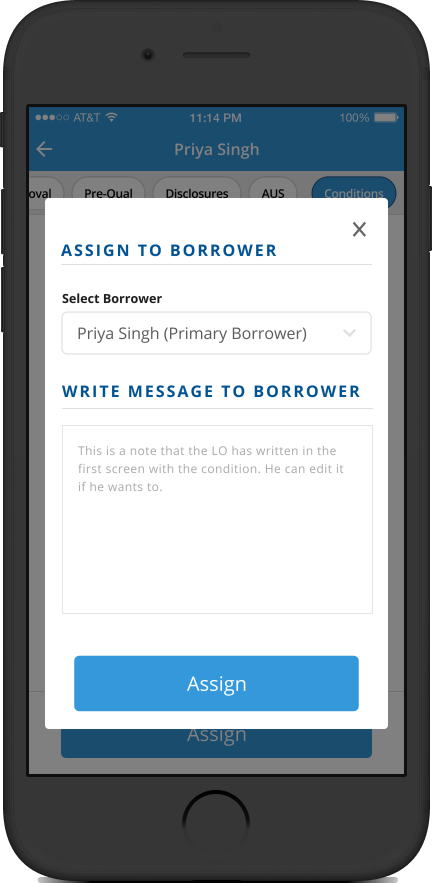

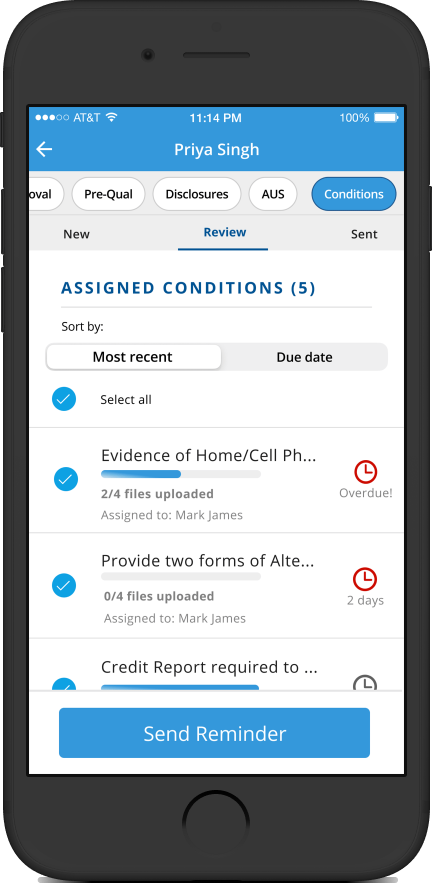

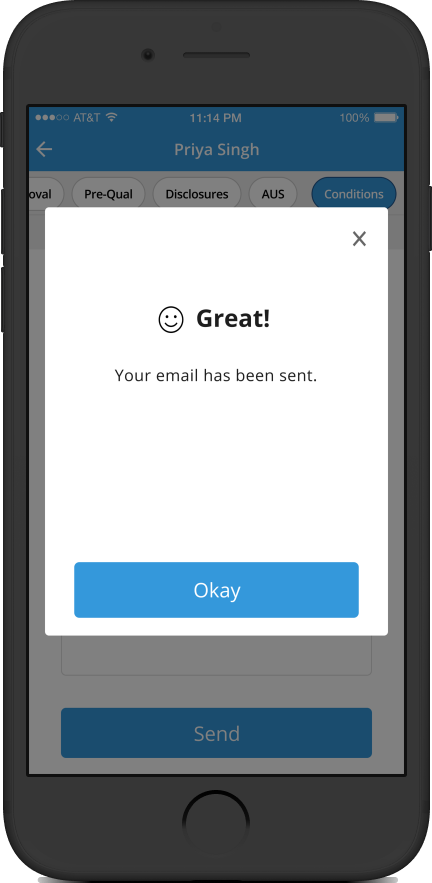

Keep loan requirements on track with built-in messages and reminders

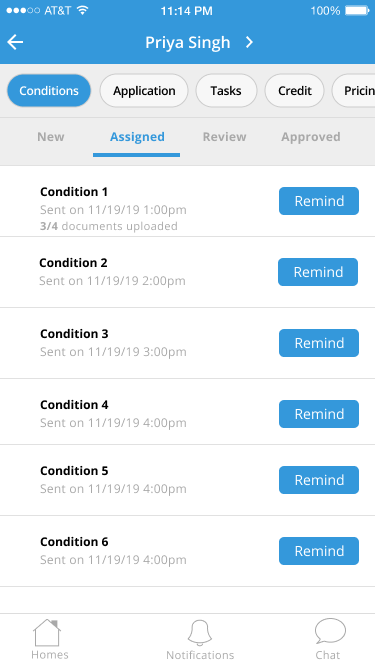

Sending a reminder or message to a borrower is a breeze. Say goodbye to miscommunication and late documents.

User Interviews & Industry Research

Loan officers = the key coordinator between the borrower & underwriter

I interviewed 5 loan officers to better understand their current process and pain points. I categorized the consistently revealed pain points into the 3 most important areas of opportunity for the new loan requirement feature:

Document Collection Is Difficult

The biggest obstacle loan officers face is collecting documents from borrowers

Messaging Is Crucial

Loan requirements can be confusing and officers act as translators to explain mortgage loan jargon to borrowers

Reminders Are Necessary

Loan requirements are time-sensitive and it's crucial to view new requirements as soon they arrive from the underwriter

Design Iterations

Developing the loan process flow

According to user interviews and industry research, loan officers need help accomplishing several key tasks:

- ViewSee loan requirements from the underwriter

- Assign Notify the borrower that new loan requirements are due

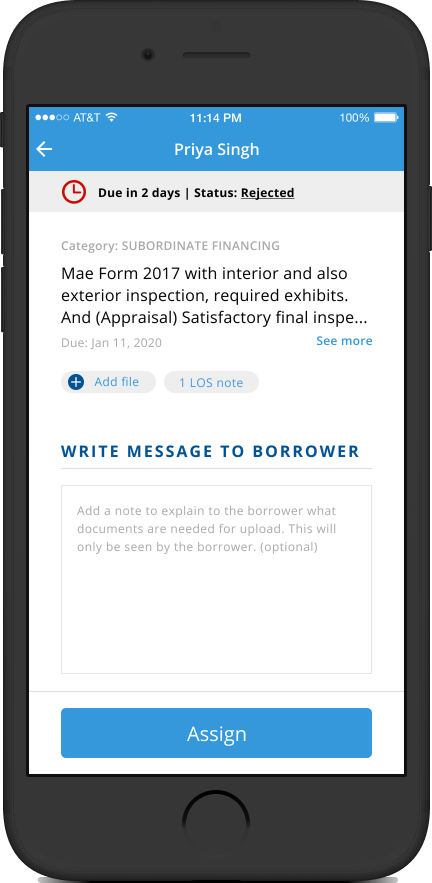

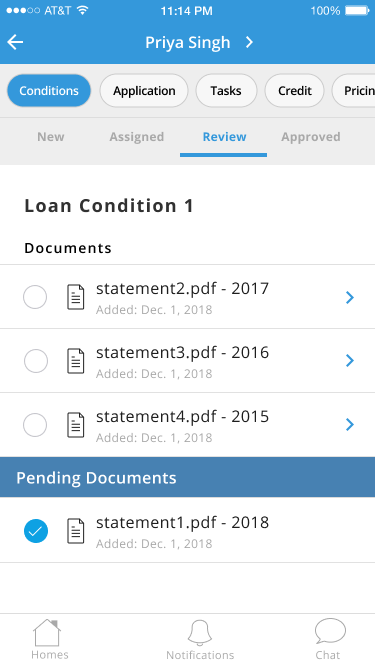

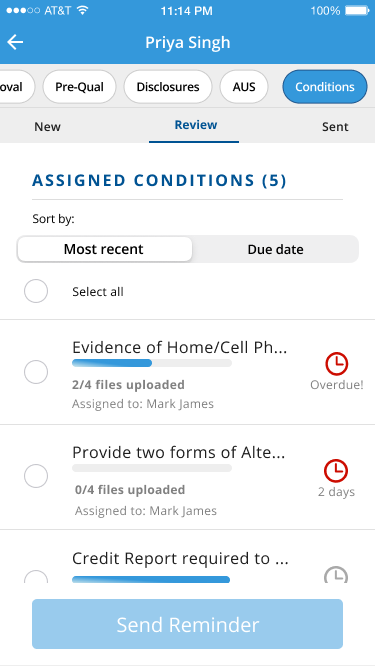

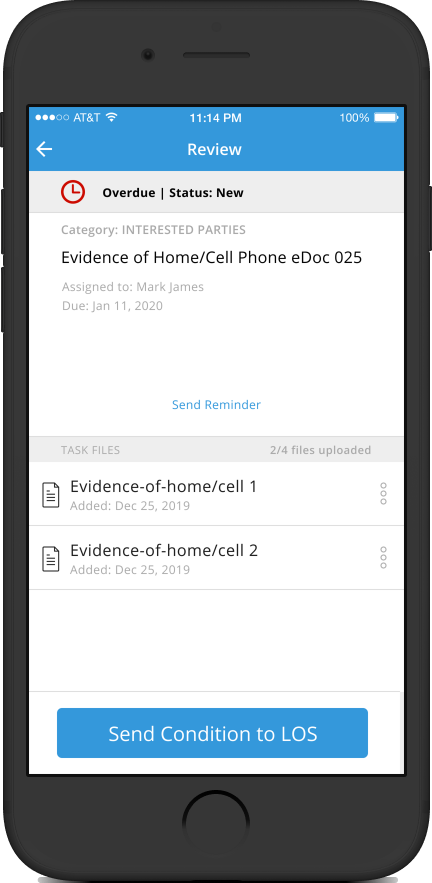

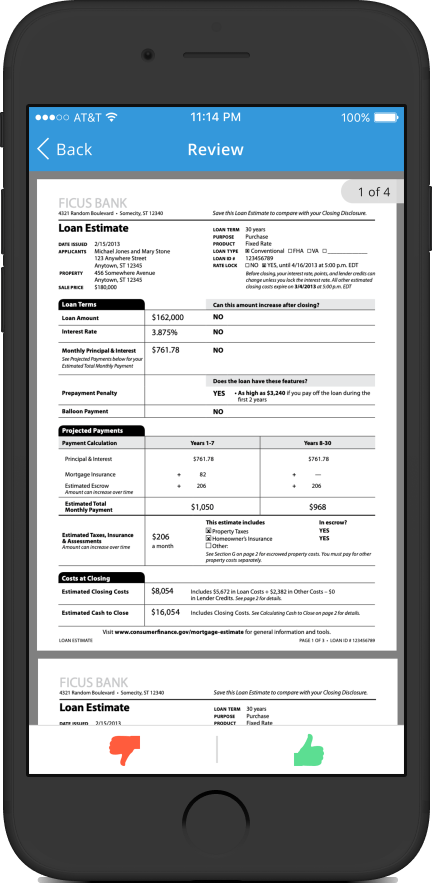

- Review Accept or decline documents uploaded by the borrower

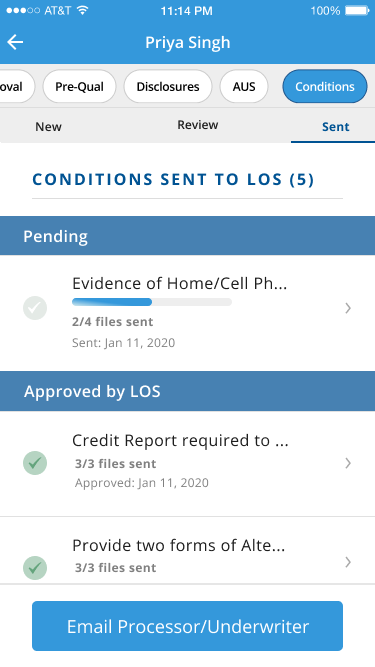

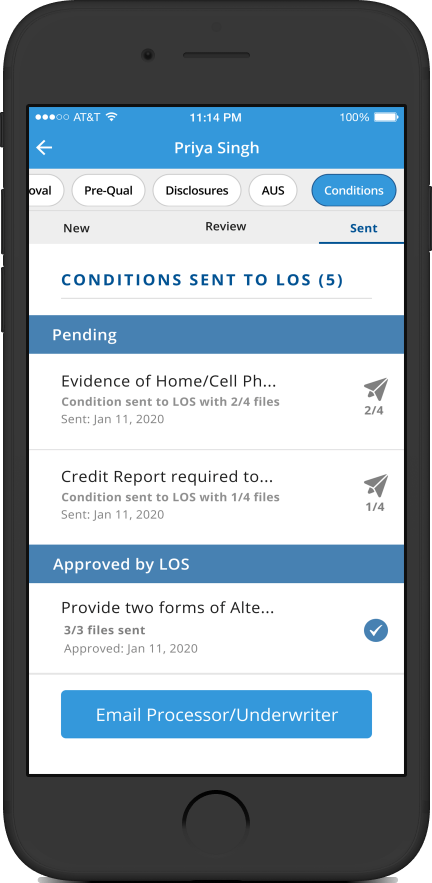

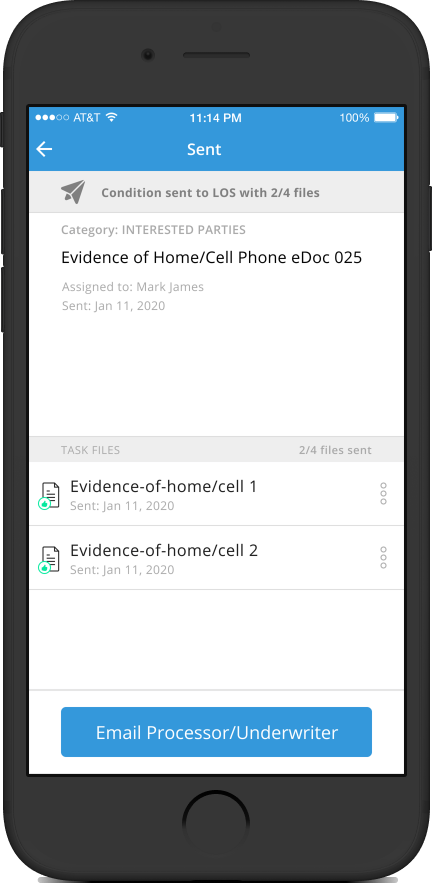

- Email Send accepted documents to the underwriter for approval

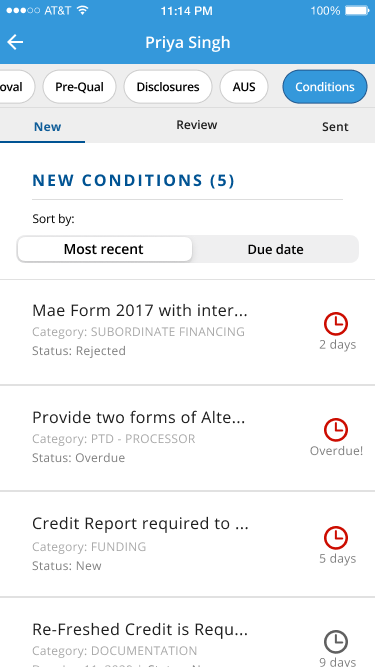

Iteration 1: Deciding on navigation tabs

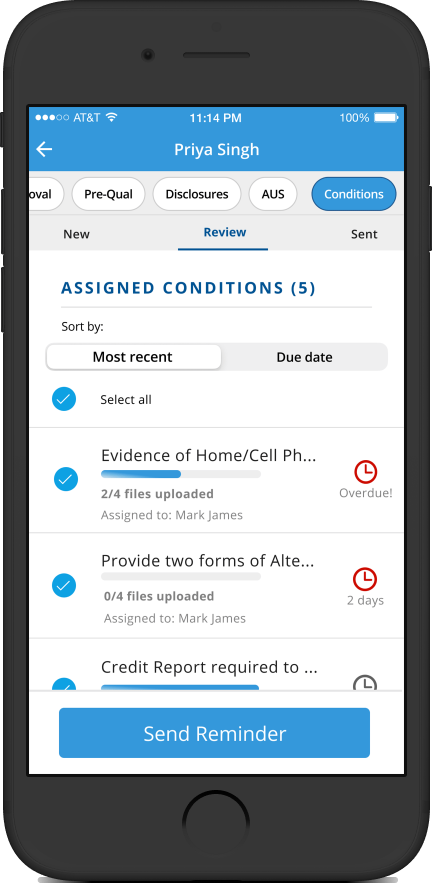

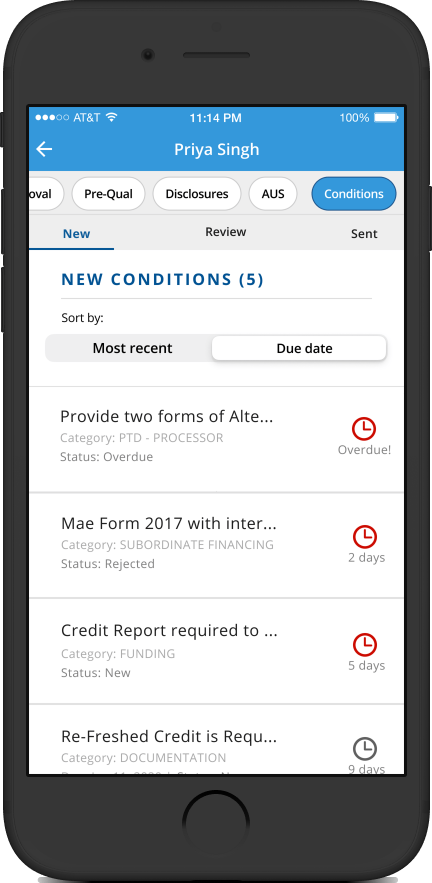

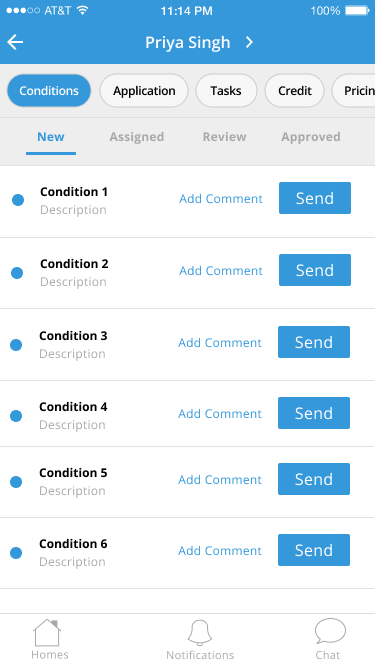

Early iterations translated key tasks that a loan officer needs to complete into submenu categories.

I chose navigation tabs since submenu categories needed to be separated into distinct sections and tabs provide a clear indication of where the user is on the app.

Iteration 2: Reducing the number of clicks to see available jobs

Segmented controls and check-mark lists were added to the designs below. I defaulted to the complex architecture because:

- The StreamLoan user was familiar with the existing pattern

- It followed the existing styleguide which was a required for Phase 1

Based on needs from user interviews, I added clock icons and progress bar to help loan officers track loan requirements at a glance.

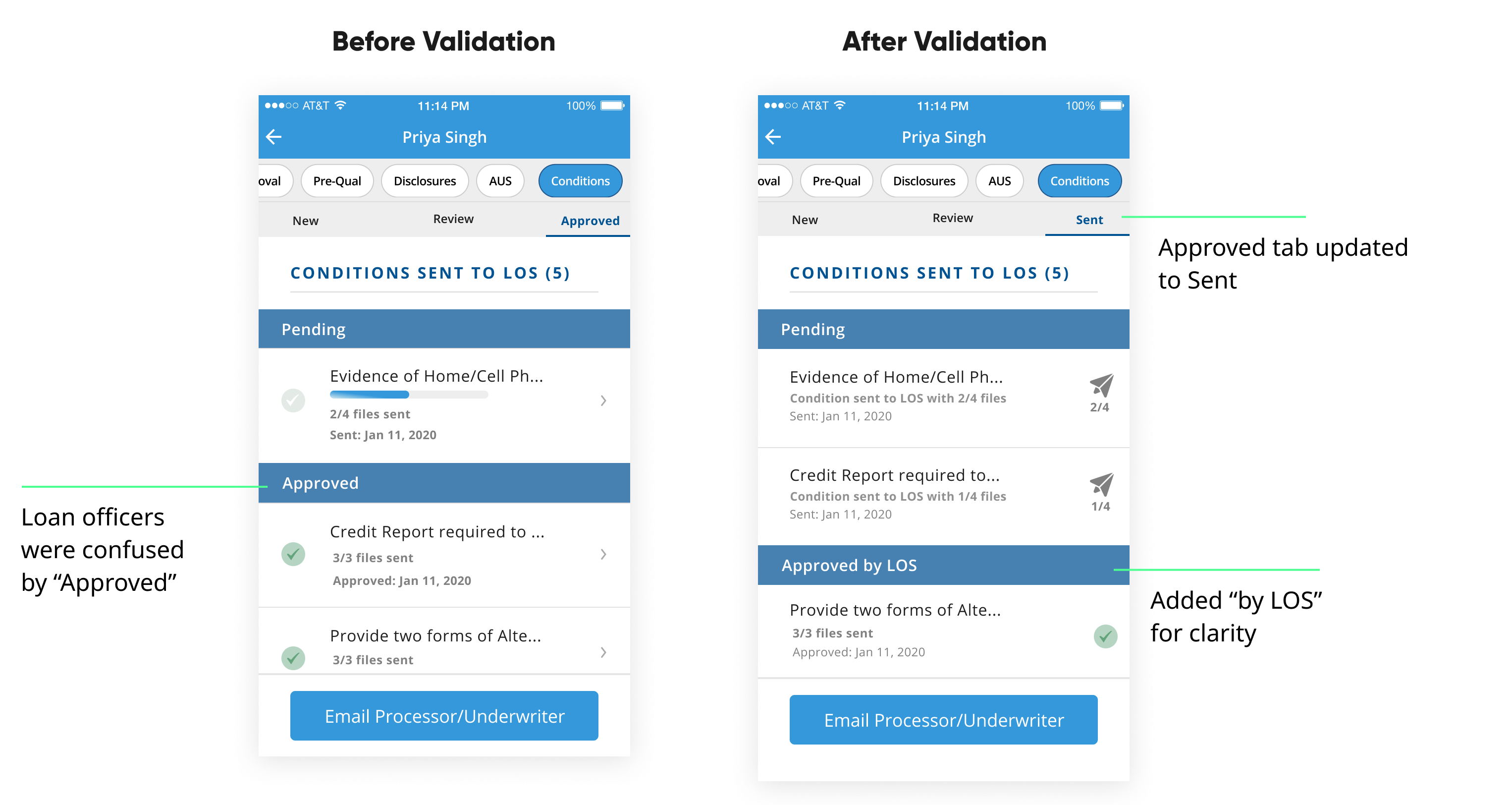

Validation Test Learnings

Industry terminology matters

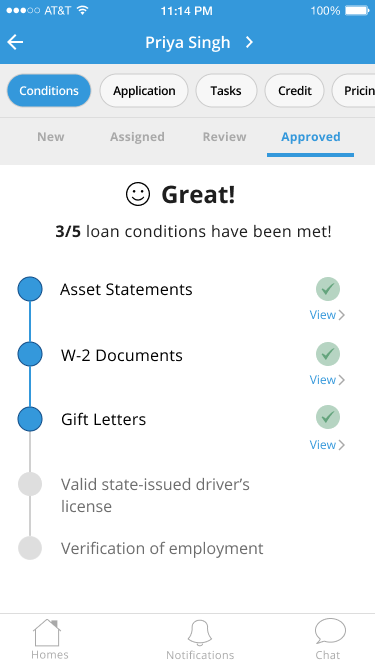

Validation testing with loan officers revealed that they are not legally allowed to approve loan conditions (only underwriters can). To avoid friction, I changed the Approved submenu to Sent. The updated tab allows loan officers to see which documents were sent to the underwriter.

Final Screens

Managing loan requirements doesn't have to be a headache

Easily track, assign, and review loan requirements in one central place. From messaging to reminders, quickly complete the loan process without the confusion.

See and assign new loan requirements

Review, accept, or decline documents

Send accepted loan documents to the underwriter for approval

Final Outcome

Evaluating the new feature's success

The StreamLoan team is currently working on implementing the final designs. I will determine if the loan requirement feature is a success based on the following metrics:

Metrics of Success:

- Increase of loan requirment completion rate

- Improvement of loan officer satisfaction rate

Final Thoughts

Design for the worst case scenario

I found that it's important to break designs as soon as possible to account for unexpected/worst-case scenarios. Data will not always be populated and loan requirement copy, condition category, and borrower name (just to name a few) could all vary in size and length. Starting with the worst case scenario allowed for defined rules and better design decisions which led to a final product with a better overall experience.